Enhancing Operational Efficiency Through the Importance of Risk Management

Enhancing Operational Efficiency Through the Importance of Risk Management

Blog Article

The Significance of Understanding the Importance of Risk Management in Different Industries

The Core Principle of Risk Management and Its Objective

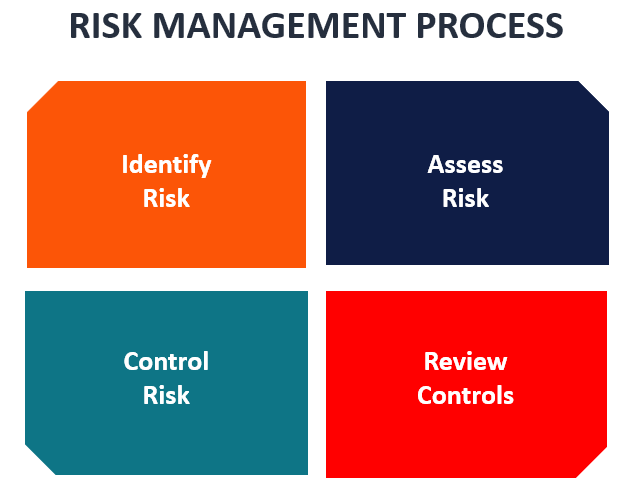

Risk Management, the foundation of several markets, hinges on the identification, analysis, and reduction of unpredictabilities in a business environment. By properly identifying possible risks, businesses can create approaches to either prevent these threats from happening or reduce their impact. As soon as threats have been determined and assessed, the reduction process involves creating approaches to lower their possible influence.

Benefits of Carrying Out Risk Management in Company Operations

Unveiling the Duty of Risk Management in Different Industries

While every industry confronts its one-of-a-kind set of threats, the implementation of Risk Management approaches stays a common in their pursuit of sustainability and growth. In the health care field, Risk Management requires making certain patient safety and data security, while in money, it includes mitigating financial investment dangers and ensuring regulatory conformity (importance of risk management). Building and construction firms concentrate on employee safety, job hold-ups, and spending plan overruns. In the innovation field, companies minimize cybersecurity hazards and technology obsolescence. Ultimately, the function of Risk Management throughout markets is to recognize, evaluate, and mitigate threats. It is an essential component of critical planning, making it possible for organizations to protect their properties, take full advantage of chances, and attain their goals.

Real-life Study Showing Effective Risk Management

To recognize the importance of Risk Management in these several sectors, one can want to several real-life instances that illustrate the successful application of these steps. In the power market, British Petroleum developed Risk mitigation prepares post the 2010 Gulf of Mexico oil spill. They implemented much better safety treatments and stricter laws which dramatically minimized read this post here further mishaps. In a similar way, in money, Goldman Sachs efficiently navigated the 2008 economic situation by determining go to my blog possible mortgage-backed safeties risks early. Last but not least, Toyota, publish the 2011 earthquake in Japan, revised its supply chain Management to lessen disturbance dangers. These instances show how industries, discovering from situations, properly used Risk Management methods to decrease future dangers.

Future Fads and Developments in Risk Management Methods

As the world continues to evolve, so as well do the trends and growths in Risk Management techniques. Fast developments in innovation and information analytics are improving the Risk landscape. Big data and AI are now critical in forecasting and minimizing risks. Organizations are leveraging these devices to build anticipating versions and make data-driven decisions. Cybersecurity, when an outer issue, has catapulted to the forefront of Risk Management, with approaches concentrating on detection, feedback, and prevention. The assimilation of ESG (Environmental, Social, Governance) factors into Risk Management is one more expanding pattern, showing the raising acknowledgment of the function that ecological and social dangers play in service sustainability. Therefore, the future of Risk Management hinges on the blend of innovative technology, innovative techniques, and an all natural approach.

Verdict

In conclusion, recognizing the significance of Risk Management throughout a range of sectors is important for their longevity and success. Eventually, effective Risk Management adds to extra sustainable and resilient companies, highlighting the value of this technique in today's highly competitive my company and vibrant organization setting.

While every market faces its one-of-a-kind set of risks, the implementation of Risk Management methods stays a typical denominator in their pursuit of sustainability and growth. In the medical care field, Risk Management requires ensuring client safety and security and information protection, while in money, it entails mitigating investment threats and guaranteeing governing conformity. Ultimately, the function of Risk Management throughout industries is to determine, assess, and minimize risks. These situations show exactly how markets, learning from crises, successfully applied Risk Management techniques to reduce future threats.

Report this page